(This is an excerpt from an article I originally published on Seeking Alpha on October 7, 2015. Click here to read the entire piece.)

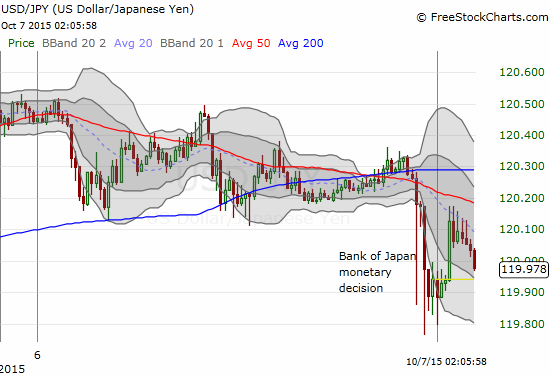

The Bank of Japan put on a brave face as it announced its latest decision on monetary policy (October 7, 2015) with a big miss on its inflation target looming in the background…

{snip}

Yet, the BoJ insists that “inflation expectations appear to be rising on the whole from a somewhat longer-term perspective.” This claim apparently helps give the central bank confidence that its program of quantitative and qualitative easing (QQE) is working and still on track to deliver on its 2% inflation target:

{snip}

{snip}

Source: FreeStockCharts.com

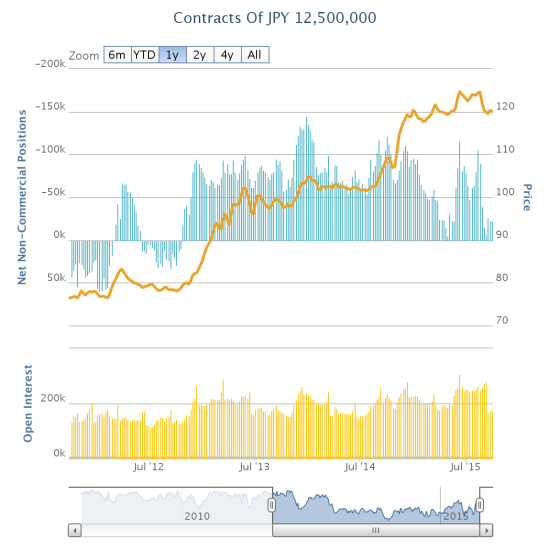

{snip}…the last time it was this low was in late 2012 just as the Japanese yen began its huge run of weakness in the wake of the Bank of Japan’s freshly aggressive monetary accommodation.

Source: Oanda’s CFTC’s Commitments of Traders

I have assumed that this retreat by speculators represents a desire to reduce risks in the face of increased volatility and the increased uncertainty over how major central banks might respond. Since changes (increased short positions) from these levels have in the past accompanied a weakening trend in the Japanese yen, I am closely watching positioning for clues on the direction for the break of the current trading logjam.

Be careful out there!

Full disclosure: net long Japanese yen

(This is an excerpt from an article I originally published on Seeking Alpha on October 7, 2015. Click here to read the entire piece.)