(This is an excerpt from an article I originally published on Seeking Alpha on September 18, 2015. Click here to read the entire piece.)

If you have followed the CME Group 30-Day Fed Fund futures prices, today’s decision by the Federal Reserve to leave interest rates unchanged did not surprise you. You may have even found the meeting as anti-climactic as I did. For several weeks going into this decision, the Fed Fund futures barely cracked 30% odds for a rate hike in September and went under 20% at several points. For several months, it was a rare day that the odds of a September hike peaked over the 50/50 point. The chart below breaks down the odds by meeting month as they stood just ahead of the decision. (Note that I made an adjustment to the “previous day” odds using values I recorded from the CME site on that day).

Source: CME Group FedWatch

{snip}

What the market prices in is what the market gets for now. {snip}

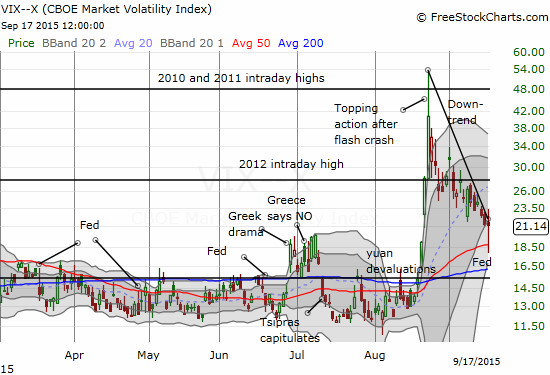

The volatility index, the VIX, presented the Fed with a huge irony on the day. While financial instability in global markets weighed on the Fed’s decision, the VIX seems already prepared to move on from such fears. After peaking during the flash crash of August 24, 2015, the VIX tumbled sharply going into the Fed’s decision. While the VIX ended the day essentially flat, it swung wildly from one interpretation of the Fed’s decision to another interpretation.

In other words, the market had already become a lot more comfortable with the potential outcomes of the Fed meeting. I interpreted this decline as the market’s acceptance of the no rate hike scenario.

In its statement, the Fed admitted that global volatility weighed on its CURRENT decision but did not change its current OUTLOOK.

{snip}

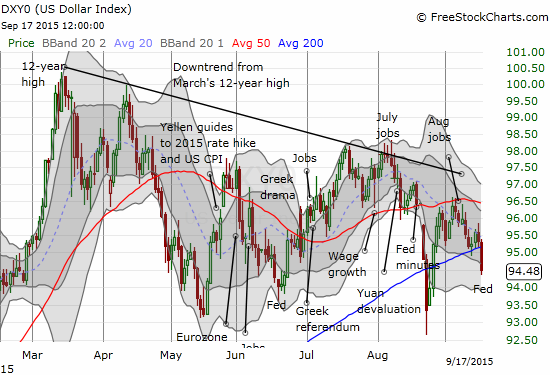

My prelim Fedageddon assessment: No material change in Fed's approach, just no hike now. Opp to buy $USDX and fade commodity lifts. #forex

— Duru A (@DrDuru) Sep. 17 at 12:05 PM

{snip}

{snip}

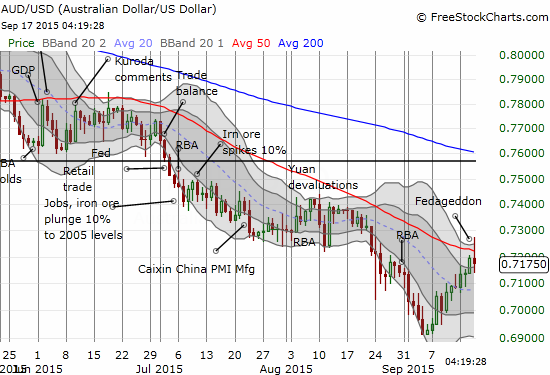

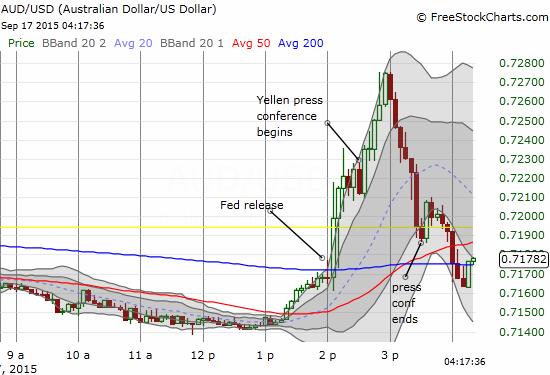

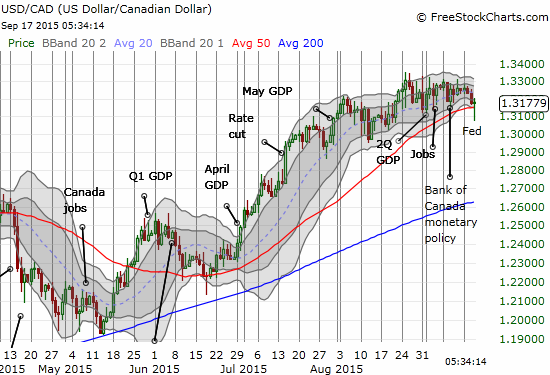

With this chart, it is more clear that the market reacted dramatically to developments surrounding the monetary policy statement. For me, the Fed’s bottom-line coming out of the decision is the inevitability of policy normalization even if the exact timing of lift-off remains squishy. {snip}

During the Q&A, Yellen was consistent and firmly steeped in the themes of normalization. {snip}

For those who want to keep wringing their hands over the timing of the first rate hike and the path thereafter by parsing and cross-examining every utterance by every Fed member, Yellen sighed, with a hint of frustration, that she considers such angst unfortunate. {snip}

{snip}

{snip}

The dollar index sits at an interesting cross-roads. {snip}

{snip}

Source for currency charts: FreeStockCharts.com

In the spirit of an anti-climactic outcome for the September Fed meeting, the path forward from here may look a lot like the path leading into this point: the same conversations, the same debates, the same data dependencies, the same spin cycles on who said what from the Fed. The main wildcard now is whether the market has finally resigned itself to get comfortable with this reality. I continue to prefer to watch what the market IS doing as opposed to wrestle with what the Fed SHOULD do.

The September 17, 2015 Federal Reserve press conference starring Chair Janet Yellen

Be careful out there!

Full disclosure: net short the Australian dollar, long the U.S. dollar

(This is an excerpt from an article I originally published on Seeking Alpha on September 18, 2015. Click here to read the entire piece.)