(This is an excerpt from an article I originally published on Seeking Alpha on September 1, 2015. Click here to read the entire piece.)

The Reserve Bank of Australia (RBA) delivered another plain vanilla decision on monetary policy. The RBA barely even acknowledged the stomach-churning volatility of the past two weeks or so.

{snip}

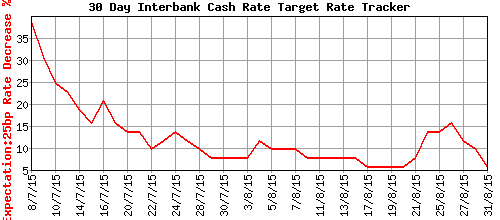

Markets did not expect the RBA to cut rates in this meeting. The odds had fallen all the way to 6%.

Source: The ASX RBA Rate Indicator

Indeed, in this latest decision, the RBA sounds relatively unfazed by global developments. The RBA does not sound like it will respond at all. {snip}…I am pretty sure the RBA will be disappointed in waiting until December for a hike as markets currently project.

Understandably, the Australian dollar barely budged in response to the RBA’s announcement. Still, the currency is skirting along the edge of a fresh breakdown against the U.S. dollar.

Source: FreeStockCharts.com

As a quick sidenote, the weakening Australian dollar is at least having the intended impact on commodity producers within Australia. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 1, 2015. Click here to read the entire piece.)

Full disclosure: short the Australian dollar, long GLD