(This is an excerpt from an article I originally published on Seeking Alpha on August 20, 2015. Click here to read the entire piece.)

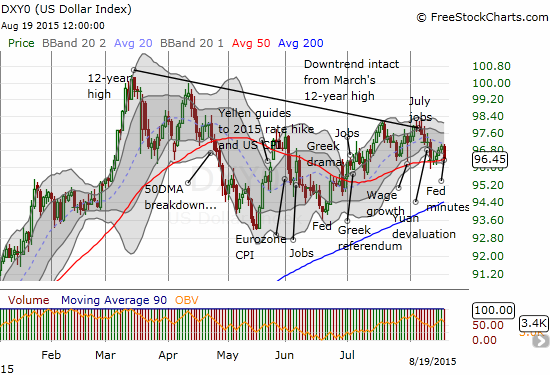

The U.S. Federal Reserve released its minutes from its July 28 to 29, 2015 meeting. It was pretty much the same back and forth on monetary policy and the U.S. and global economies, but the words took on more significance than usual because of all the anticipation about the timing of the Fed’s first rate hike on the way to normalization. One net effect of the hemming and hawing was to send the U.S. dollar index (UUP, UDN) down.

{snip}

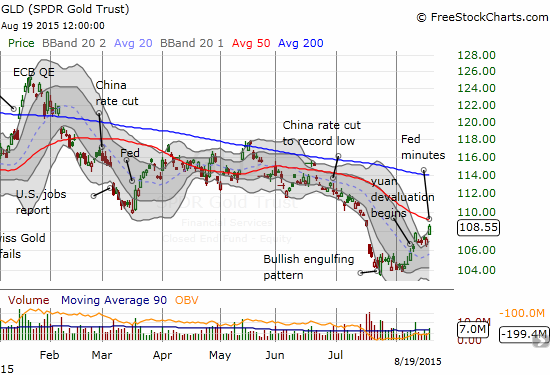

More importantly for me on this day, the SPDR Gold Shares (GLD) responded to the dollar weakness with a gain of 1.3%. {snip}

Source for charts: FreeStockCharts.com

The rally in GLD is notable and marks yet another validation of the use of Google trends to assess market sentiment in the face of extreme movements in gold’s price. In “The Commodity Crash Accelerates: A New Juncture for Buying Gold,” I made the case for a bottom in gold. {snip}

Once again, Fed-speak gave no definitive clues on the timing for a first rate hike. Those who expected more are experiencing the triumph of hope over experience. I divided the relevant components of the minutes into two camps: “yes, let’s hike” and “yes, well, but…”

YES, LET’S HIKE

{snip}

Someone at the Fed is already very itchy at the trigger…

{snip}

YES, WELL, BUT….

The cautious members of the Fed look out nervously upon the horizon. For example, they take no assurance in a transitory impact on inflation. Add to the list of “international developments” the devaluation of the Chinese yuan. This (still on-going) event seems to underline economic troubles in China which in turn potentially translate to troubles in other economies. If so, the Fed has yet one more reason to proceed with extreme caution on normalization.

{snip}

EVERYBODY TOGETHER NOW

Interestingly, the entire Committee appears to be in agreement that it needs yet MORE data to get comfortable with policy normalization.

{snip}

Be careful out there!

Long GLD shares and call options

(This is an excerpt from an article I originally published on Seeking Alpha on August 20, 2015. Click here to read the entire piece.)