(This is an excerpt from an article I originally published on Seeking Alpha on July 6, 2015. Click here to read the entire piece.)

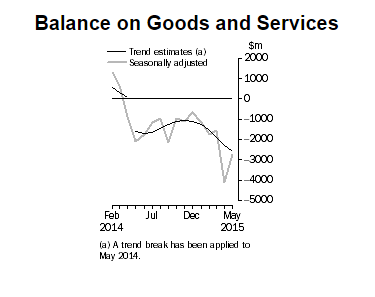

On Wednesday, July 1, 2015 the Australian Bureau of Statistics (ABS) released international trade data for May which suggested that April’s big plunge may have been quite an aberration. On a seasonally adjusted basis, Australia’s balance on goods and services jumped 33% from -$4.14B to -$2.75B (AUD).

Source: International Trade in Goods and Services, Australia, May 2015 from the Australian Bureau of Statistics (ABS)

{snip}

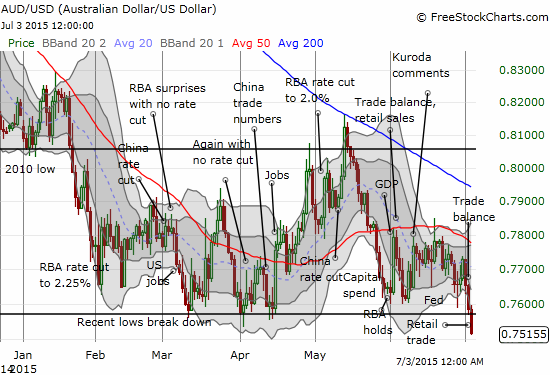

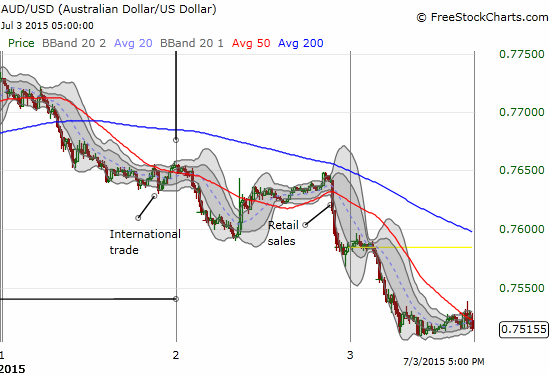

All-in-all, the report on imports and exports was relatively sound. Of course, Australia is still contending with a downtrend in its trade balance as shown by the above chart. The immediate impact on the Australian dollar was minimal. Traders reflexively sold the Australian dollar (FXA) in the first 15 minutes or so of trading. Within a few hours, the Australian dollar completely recovered and then some (see the chart at the end of this piece for more detail). The real impact on the Australian dollar came in the wake of retail sales data that preceded the U.S. Independence Day trading holiday.

{snip}

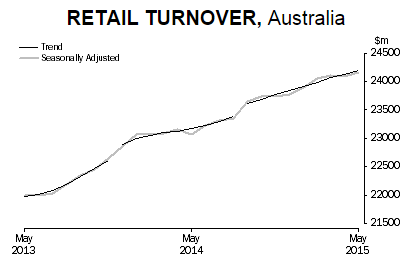

Source: The Australian Bureau of Statistics (ABS)

I was quite surprised by the extremely strong and sustained sell-off on the Australian dollar in response to these numbers. I strongly suspect that low liquidity form holiday trading in the U.S. was at least partially responsible. {snip}

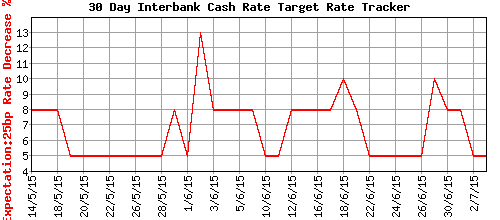

Source: ASX RBA Rate Indicator

{snip}

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: net long the Australian dollar, net long the British pound

(This is an excerpt from an article I originally published on Seeking Alpha on July 6, 2015. Click here to read the entire piece.)