(This is an excerpt from an article I originally published on Seeking Alpha on June 28, 2015. Click here to read the entire piece.)

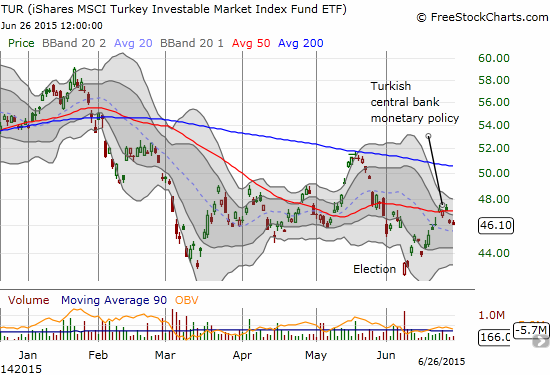

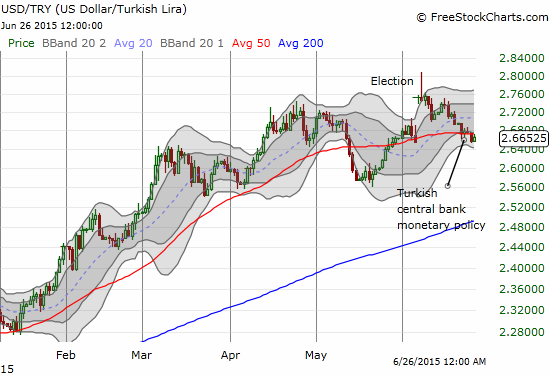

Since I laid out a post-election trading strategy on the Turkish Lira (USD/TRY) two weeks ago, events have gone on a very slow burn. The currency and the stock market have been surprisingly calm overall despite the unfolding wrangling to form a government. Post-election gaps filled this past week.

Source: FreeStockCharts.com

So the narrative for a complete reversal of the post-election gap played out after all. {snip}

There remains an important economic wildcard looming over this trade. As the charts above show, the Turkish central bank issued its latest statement on monetary policy on June 23, 2015 (I used Google Translate to read it). That event happened to coincide with the current top on TUR. The Bank decided to keep rates constant despite the weakening currency. The continued lack of action implies that the Bank may still feel political pressure to avoid rate hikes even after the recent election should have relieved some of this pressure.

On the inflation front, the Bank seems content to hope inflationary pressures abate on their own. {snip}

Source: TradingEconomics.com

The Bank pointed to volatility in food and energy prices and to “uncertainty in global markets” as reasons for staying cautious on policy. {snip}

Be careful out there!

Full disclosure: long USD/TRY

(This is an excerpt from an article I originally published on Seeking Alpha on June 28, 2015. Click here to read the entire piece.)