(This is an excerpt from an article I originally published on Seeking Alpha on June 14, 2015. Click here to read the entire piece.)

Turkey held national elections on June 7th. The events were well-covered given Turkey’s central location amid a set of geopolitical hotspots and its (former) place as a fast-growing emerging market.

Source: Google Maps

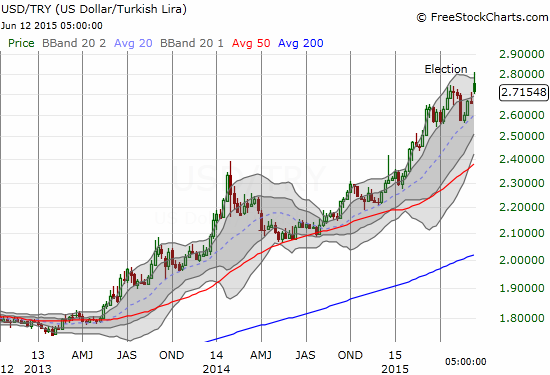

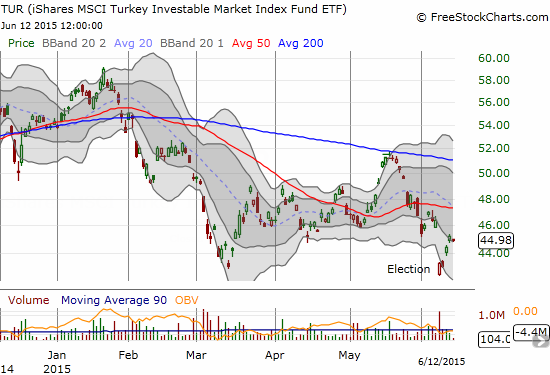

The elections had a strong impact on the Turkish lira and the Turkish stock market. The trading action provided another one of those great demonstrations of trading on a market narrative.

{snip}

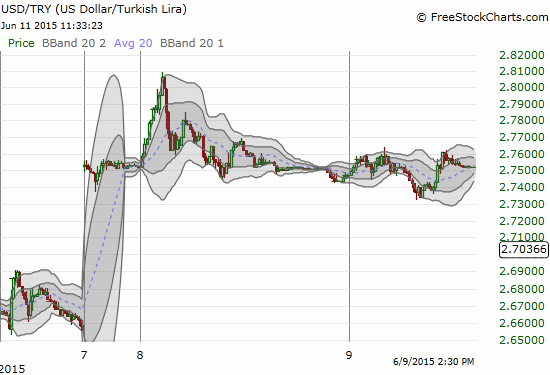

From the perspective of the presumed operating narrative, the market’s reaction made little sense to me. So I faded pops higher on USD/TRY from Sunday through Wednesday for very short-term trades. {snip}

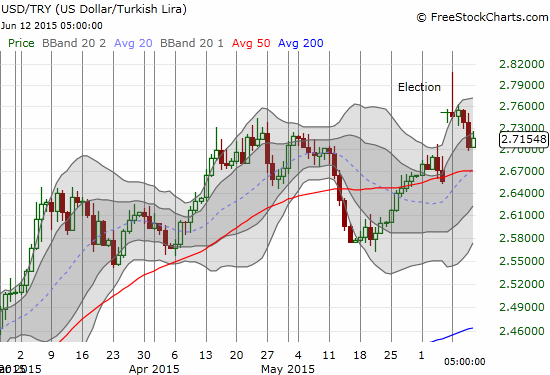

At the time I was fading USD/TRY, I did not realize that Turkey’s central bank moved quickly to try to support the currency. {snip}

While my read of the narrative worked out, I stopped short of anticipating a complete fill of the post-election gap. {snip}

Source for above charts: FreeStockCharts.com

As the chart above shows, it is very easy to see from a technical perspective how USD/TRY could complete a gap-fill. Such a move would perfectly align with the converged 20 and 50-day moving averages (DMAs). I would look to accumulate more in that case, but end the trade if downward momentum persists.

The narrative going-forward is more complicated because at any time, encouraging news about the formation of a government could generate more downside for USD/TRY. Moreover, the central bank could take further actions to try to support the currency. If either event occurs, I will be inclined to switch the trading bias n USD/TRY back to short.

{snip}

Be careful out there!

Full disclosure: long USD/TRY

(This is an excerpt from an article I originally published on Seeking Alpha on June 14, 2015. Click here to read the entire piece.)