(This is an excerpt from an article I originally published on Seeking Alpha on October 13, 2014. Click here to read the entire piece.)

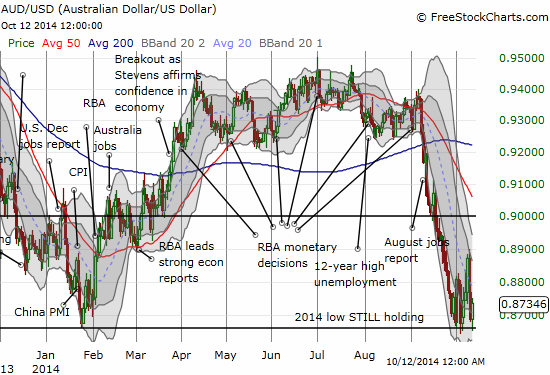

In “The dollar keeps falling: What’s happening to our economy?” Gareth Hutchens of the Sydney Morning Herald tries to explain to the everyday reader how the Australian dollar’s (FXA) twists and turns relate to Australia’s economic prospects. {snip}

Anyway, Hutchens goes on to explain some of the mechanics of how the currency’s moves ripple through the Australian economy. It is is difficult to come to a final conclusion because Hutchens identifies two distinctly counter-acting forces: a drop in Australian earnings repatriated into the country versus more competitive pricing of Australian exports which could increase export volumes. {snip}

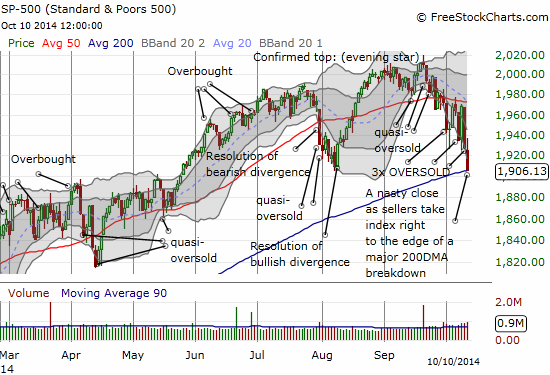

One thing seems clear if trading on the S&P 500 (SPY) is any indication: the Australian dollar is sympathetic with, and perhaps even linked to, market sentiment in the U.S. The Australian dollar has stood between “here” and a market correction twice already this year, and it could very well signal the difference this time around as well.

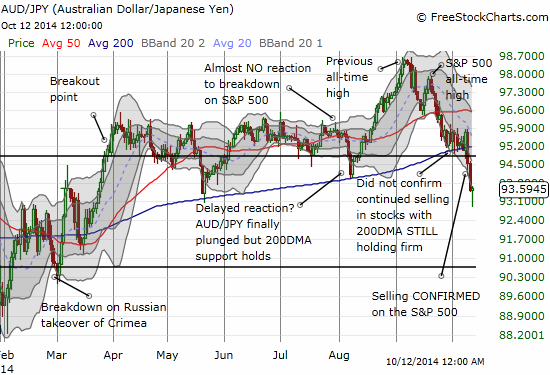

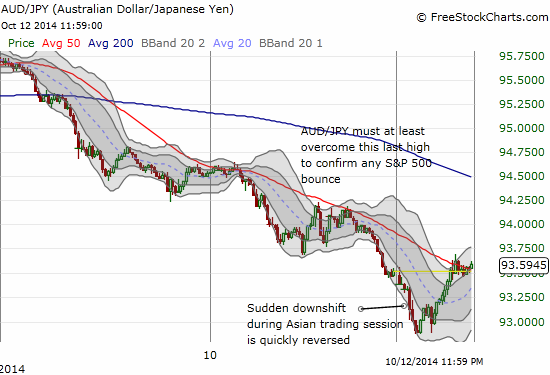

In particular, the Australian dollar combined with the Japanese yen (FXY) has repeatedly come through as a key indicator for navigating a period of increased volatility for the S&P 500 (SPY). I discussed the prospects for this signaling at the end of last year.

{snip}

What is more clear from hindsight is that AUD/JPY also failed to confirm the last all-time high on the S&P 500. {snip}

Meanwhile, the potential bottom I identified in the Australian dollar versus the U.S. dollar is still holding after almost two weeks. {snip}

{snip}

This 100% long position is not easy for me since I am inclined to remain bearish on the currency. For now, short-term price action rules. Moreover, recall that I used Australia’s Bureau of Resources and Energy Economics (BREE) forecasts to estimate that the Australian dollar would survive its 2014 low against the U.S. dollar. So far, so good.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on October 13, 2014. Click here to read the entire piece.)

Full disclosure: net long the Australian dollar