(This is an excerpt from an article I originally published on Seeking Alpha on April 9, 2015. Click here to read the entire piece.)

{snip}

The most striking feature of the minutes for the mid-March meeting was the Federal Reserve’s very mixed feelings toward the timing for the first rate hike: {snip}

There are multiple scenarios in play. I accompany each one with the prediction from the Fed Funds futures.

June rate hike: 6%

{snip}

At least one rate hike by July: 15%, Sep: 32%, Oct: 50%, Dec: 61%

{snip}

Jan, 2016: 76% (44.7% chance for rate hikes up to at least 0.75%), Mar, 2016: 82% (54.5% chance for rate hikes up to at least 0.75%)

{snip}

There is a likely irony in all the time and energy spent divining the first rate hike: when it finally happens, the event seems likely to be very anti-climactic. {snip}

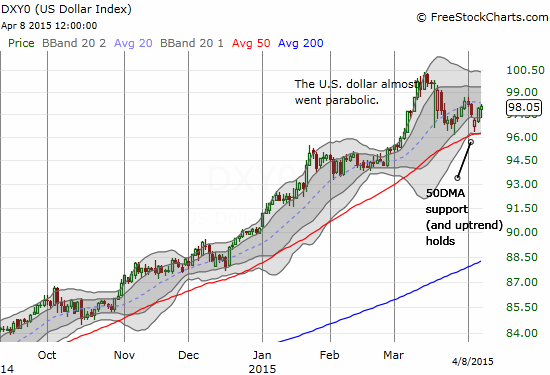

This likely volatility represents an opportunity. The persistent uptrend in the dollar is at least partially a result of policy divergence. Until that fundamental difference changes, every event that appears to or actually does stretch out the timing of the rate hike is an opportunity to buy weakness in the U.S. dollar (UUP). On the other hand, the increasing uncertainty in the timing of the first hike means that the dollar’s gains are likely tightly capped, all else being equal.

Also capping the potential for additional appreciation in the U.S. dollar is the identification of the dollar as a disinflationary force in the economy (emphasis mine):

{snip}

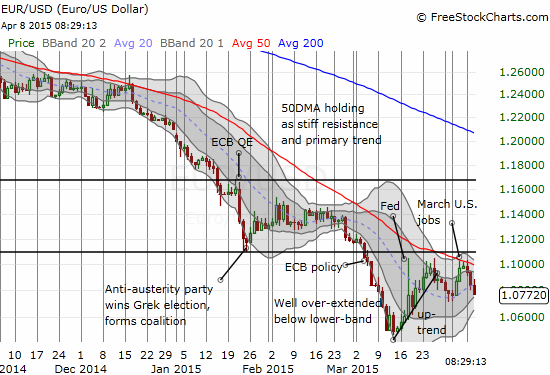

The euro (FXE) is a key component of the dollar index. {snip}

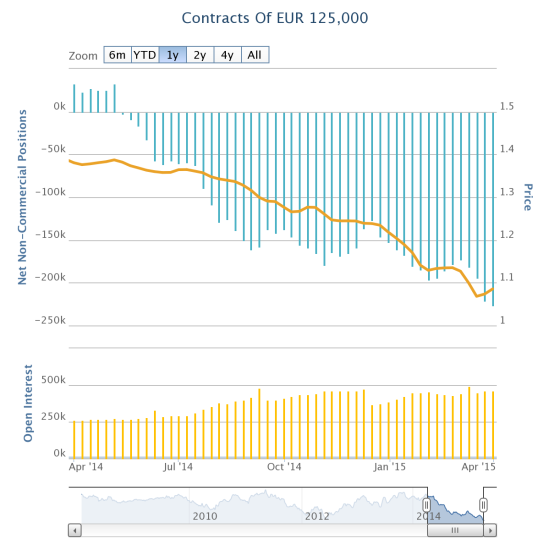

The euro promises to be particularly volatile because speculators remain extremely bearish on the currency. {snip}

Source: Oanda’s CFTC’s Committment of Traders

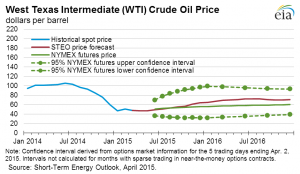

The opportunity space for the uncertainty on Fed policy normalization even extends to oil, particularly trading oil-related equities like United States Oil ETF (USO). On Monday, USO was able to hold onto its gains despite the dollar’s comeback from intra-day lows and an accompanying affirmation of its uptrend. USO extended its gains on Tuesday despite a strong day for the U.S. dollar. Wednesday’s sharp reversal demonstrated that such divergences are not likely to last long. {snip}

Source for charts: FreeStockCharts.com

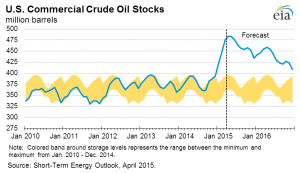

There are a myriad of supply and demand issues that also impact oil so of course it is not sufficient to consider currency impacts. {snip}

Click for a larger image…

Source: U.S. EIA

I still prefer to wait to see an inventory drawdown before I consider the technical bottom in USO shown above more or less confirmed. {snip}

Click for a larger image…

Source: U.S. EIA

{snip}

Be careful out there!

Full disclosure: net long the U.S. dollar, long USO call and put options

(This is an excerpt from an article I originally published on Seeking Alpha on April 9, 2015. Click here to read the entire piece.)