(This is an excerpt from an article I originally published on Seeking Alpha on April 9, 2015. Click here to read the entire piece.)

{snip}

China looks likely to drop that next shoe on the the iron ore market. According to Reuters:

“China is drawing up plans to subsidise its struggling iron ore sector, official media reported on Wednesday, with many high-cost mines forced to shut as a result of a collapse in global prices.

{snip}”

Later, the Sydney Morning Herald reported that the relief is taking the form of a tax cut:

{snip} Even though the tax is a small fraction of current prices even at their low levels, the tax action seems to confirm that China will do what it can to keep its industry alive through the current shakeout. As a result, expectations for a bottom in iron ore should drop to lower levels.

Gina Rinehart is one Australian miner who may not be worrying about what is going on in China – at least for now. Bloomberg recently reported news I was not aware of earlier: Rinehart’s Roy Hill mine has signed guaranteed supply agreements with several non-Chinese steel mills:

{snip}

The upshot of this news is that the Roy Hill output will displace current suppliers who will now compete, if possible, for other customers. This shift will effectively concentrate more power among the remaining buyers. So, the guaranteed contracts will help Roy Hill to the detriment of other miners at least at the margins.

{snip}

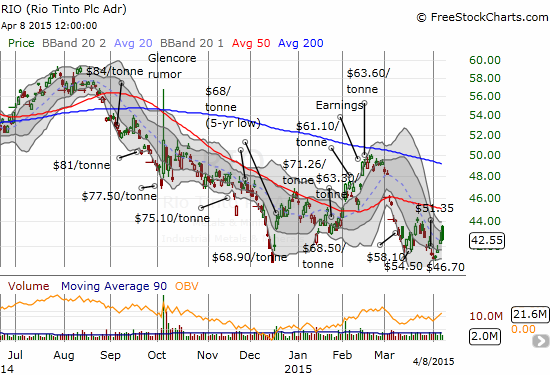

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long RIO put options

(This is an excerpt from an article I originally published on Seeking Alpha on April 9, 2015. Click here to read the entire piece.)