(This is an excerpt from an article I originally published on Seeking Alpha on April 2, 2015. Click here to read the entire piece.)

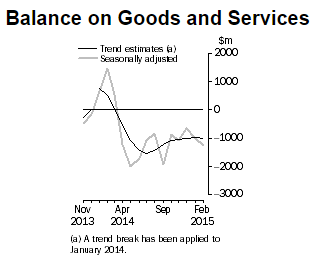

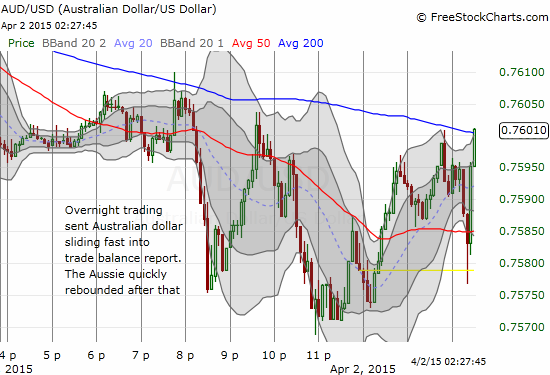

A drop in the Australian dollar (FXA) toward a fresh six-year low has not stopped Australia’s trade balance from worsening. {snip}

Source: The Australian Bureau of Statistics (ABS)

Source for currency charts: FreeStockCharts.com

Unsurprisingly, metal ores and minerals, including iron ore and coal, were the biggest drag on exports with a decline in value of $A248M. Exports of “rural goods”, like agricultural products, did most of the heavy-lifting for exports with a gain of $A390M. {snip}

With iron ore breaking through the $50/tonne mark and hitting a 10-year low, the price of Australia’s largest export is finally reaching the revised targets of several analysts. {snip}

I continue to watch Rio Tinto (RIO) for clues as to whether the market thinks a bottom in prices is nearing. Year-to-date, the stock has proven quite resilient in the face of iron ore’s persistent plunge. {snip}

{snip}

Declining iron ore seems to be greasing market expectations for another rate cut in Australia. {snip}

This pressure has me even more wary than I described in my last post on the Australian dollar. Pruning my short position to a very small size seems to make even more sense going into the decision on monetary policy. If the RBA “disappoints” with no action and no promise of future action, the Australian dollar should soar tremendously. Even if the RBA cuts, market participants could easily decide that the cut and even the potential for future ones are now priced in already, thus triggering a relief rally. In other words, the short-term catalysts for further downside in the Australian dollar are shrinking (albeit ever present given the RBA’s insistence that the currency remains over-valued).

Be careful out there!

Full disclosure: net short the Australian dollar, long RIO put options

(This is an excerpt from an article I originally published on Seeking Alpha on April 2, 2015. Click here to read the entire piece.)