(This is an excerpt from an article I originally published on Seeking Alpha on November 23, 2014. Click here to read the entire piece.)

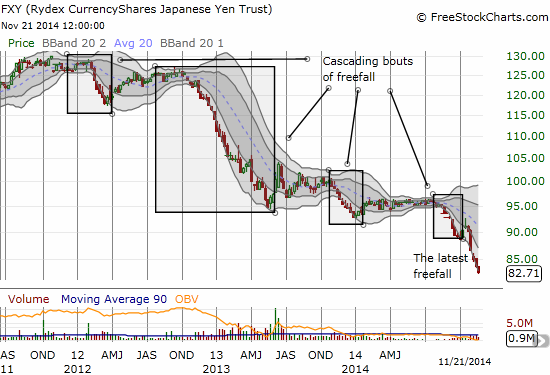

{snip} Ironically, this situation was essentially manufactured by these same authorities, but sure enough the first attempts to rein in the runaway train have appeared. Almost right on schedule, Japanese Finance Minister Taro Aso was quoted on Friday (November 21) warning that the yen’s fall has been too much, too fast. The comments had a minor impact on the yen (FXY) but of course did nothing to break the current downtrend in the currency. Here is a chart of the yen using CurrencyShares Japanese Yen ETF (FXY), an ETF that declines when the yen declines and increases when the U.S. dollar increases (the inverse of USD/JPY).

Source: FreeStockCharts.com

Any commentary from Japanese government officials that run counter to the actions being taken to weaken the currency are simply not credible. {snip}

If the Japanese government, more specifically the Bank of Japan, were truly concerned about weakness in the currency, the massive increase in QE would have been carefully orchestrated and communicated. Whether implemented in phases or whether preceded by cascading rhetoric and jawboning, the Bank of Japan could have mitigated at least some of the rapid weakness in the currency. Moreover, poor economic numbers driven by a sales tax increase earlier this year serve to further weaken support for the Japanese yen.

The 115 to 120 level on USD/JPY is interesting because this is exactly where Japanese companies reportedly wanted the government to step in to intervene to strengthen the currency. Currency weakness is fine for making exports more attractive to foreign customers but it can come back and bite a nation like Japan that imports a lot of commodities. {snip}

{snip}

The strategy in the face of the surprise move was to follow momentum – shorting the yen on further weakness. That is, weakness confirmed more weakness to come. Now it seems to me the better strategy is to fade yen rallies. {snip}

Be careful out there!

Full disclosure: short Japanese yen

(This is an excerpt from an article I originally published on Seeking Alpha on November 23, 2014. Click here to read the entire piece.)