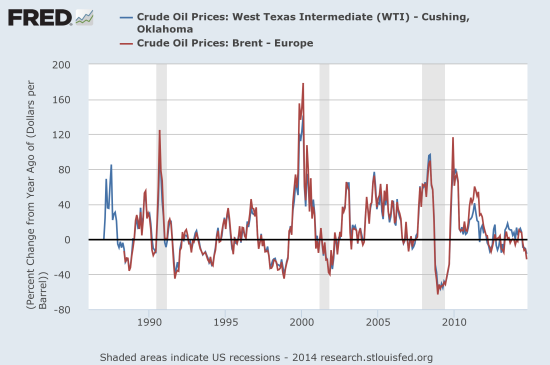

Every time oil drops these days, I notice hand-wringing about whether the fall indicates a recession is somewhere close on the horizon. There is an intuitive appeal to this assumption. Oil is still an engine of economic activity, so declining prices must indicate falling demand. What seems to be “different” this time is a true supply glut that has now been exacerbated by Saudi Arabia’s refusal to cut supply to put a floor under prices. No matter what dynamics are underway now, the recent history shows that changes in oil prices are a very poor leading indicator for recent recessions. In fact, if anything, a period of sharply RISING prices seems to be a better alarm bell for a recession.

Source: St. Louis Federal Reserve

Source: St. Louis Federal Reserve

So, enjoy this early Christmas present of lower oil and gasoline prices. The average consumer is.

Source: FreeStockCharts.com

Full disclosure: no positions