(This is an excerpt from an article I originally published on Seeking Alpha on August 7, 2014. Click here to read the entire piece.)

It is probably only a matter of time before the next deep swoon in the Australian dollar (FXA).

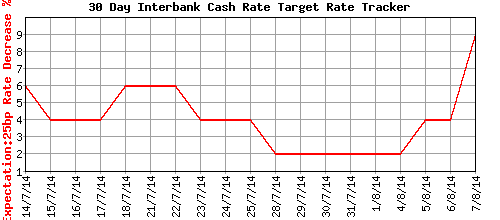

On August 7th…the Australian Bureau of Statistics (ABS) reported a spike higher in Australia’s employment rate from 6.0% in June to 6.4% in July. {snip} Accordingly, the odds of a rate cut in the September Reserve Bank of Australia meeting jumped from 4 to 9%. These are still small odds but enough to generate a large drop in the Australian dollar as the odds surely increased much higher for a rate cut later in the year.

Source: ASX Rate Tracker

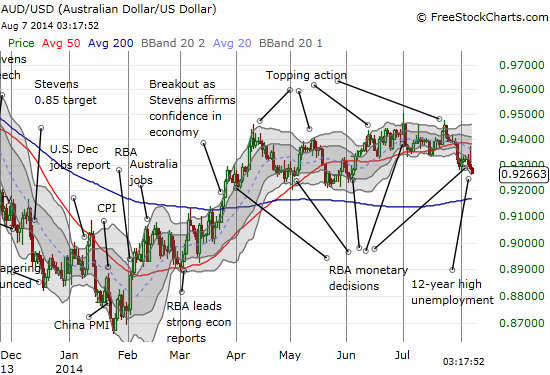

Source: FreeStockCharts.com

The one caveat to this report is that the unemployment report was mainly driven higher by a large influx of entrants into the labor force. {snip} The next few months will be critical as it is hard to imagine the RBA sitting still on interest rates if the unemployment rate starts trending higher, especially with the Australian dollar staying extremely over-valued by the Bank’s account.

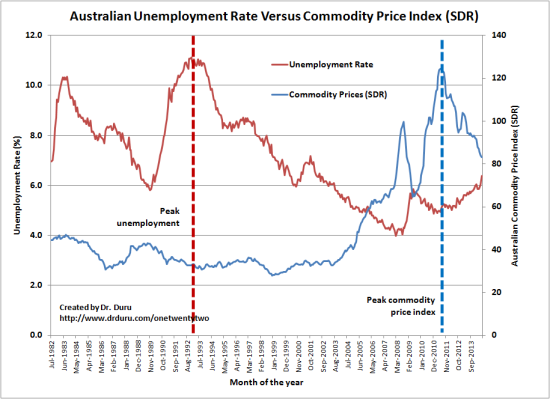

Commodity prices are also working against the premium valuation of the Australian dollar. {snip}

{snip}

Source: the Australian Bureau of Statistics and the Reserve Bank of Australia

The Australian dollar is likely key to breaking the correlation. As the RBA stated in its last decision on monetary policy (and many before that): “The exchange rate remains high by historical standards, particularly given the declines in key commodity prices, and hence is offering less assistance than it might in achieving balanced growth in the economy.”

The time for more (rate) action must be nearer than ever.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on August 7, 2014. Click here to read the entire piece.)

Full disclosure: net short the Australian dollar