Technical analysis becomes particularly precarious during earnings season, but there are some intriguing charts I felt compelled to post anyway. Some telling and strong stories here…

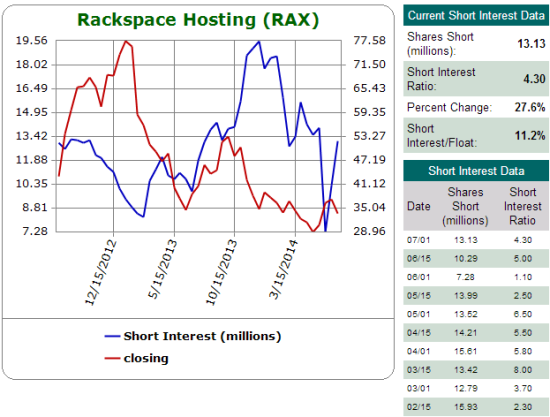

Rackspace Hosting, Inc. (RAX)

RAX has given back all its gains from the initial excitement over the potential for “strategic alternatives.” Bears have added insult to injury by rushing back into battle. Note that the open interest put/call ratio has also plunged to at least 2-year lows, so shorts are likely well-hedged…just in case.

Source: Schaeffer’s Investment Research

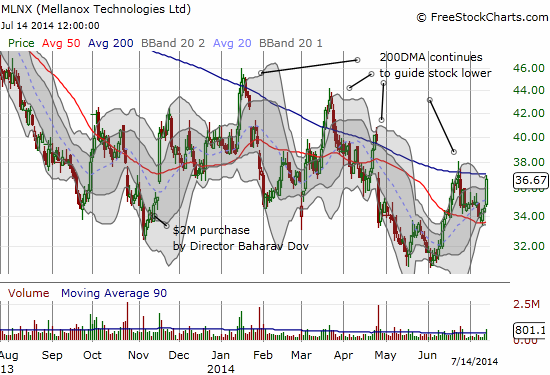

Mellanox Technologies, Ltd. (MLNX)

MLNX has struggled o build on the positive catalyst of insider buying. I remain bullish but missed this latest jump into 200DMA resistance. Once MLNX finally makes a higher high, I will get more bullish and much more aggressive in trading/buying the stock.

PowerShares DB Agriculture (DBA)

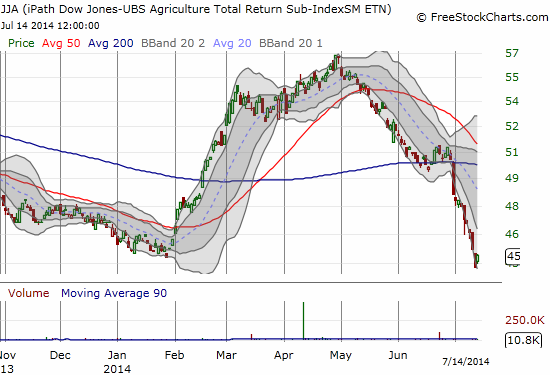

iPath DJ-UBS Agriculture TR Sub-Idx ETN (JJA)

What in the world is going on with agriculture stocks?!? The worst drought in California’s history is clearly not a concern across major ag-related indices. I really hope to have some time in coming weeks to study this closer. It is yet one more signal that casts doubt that inflation is a looming problem – even if food is not a core component of the inflation index.

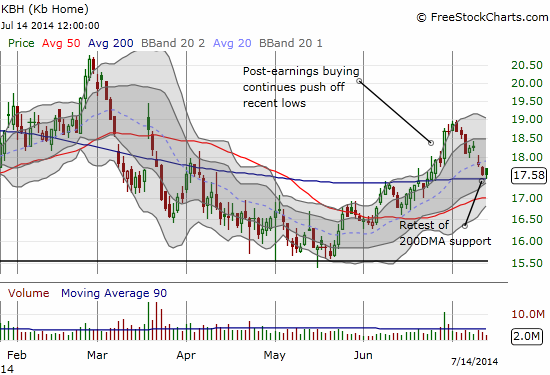

KB Home (KBH)

I was soooo hopeful that the post-earnings excitement would finally be sustained. Instead, a fresh retest of support has greeted a strong fade of the initial post-earnings surge.

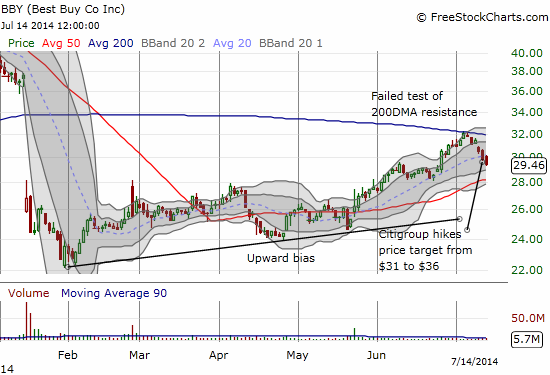

Best Buy Co., Inc. (BBY)

As I feared, the 200DMA served as stiff resistance for BBY. I have five more months to go on this call spread play. If the market turns its attention to Citigroup’s hike of its price target, then I should be golden. Still clinging to profits…

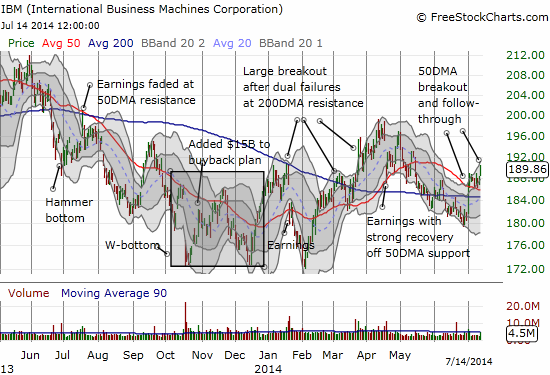

International Business Machines Corporation (IBM)

IBM has followed through with its 50DMA breakout after a short period of consolidation. This is very bullish. I need strong follow-through this week though!

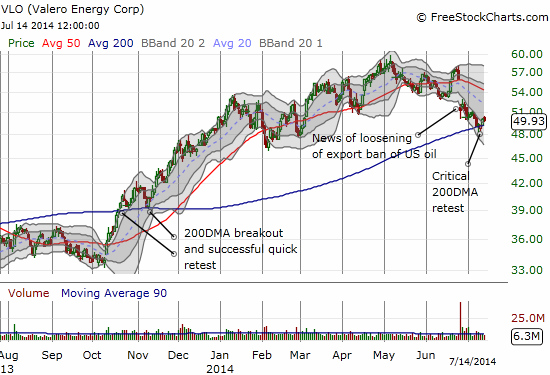

Valero Energy Corporation (VLO)

I have kicked myself for a long time now for not participating in the recent run-up in refiner stocks. I was very bullish refiners back during the run-up at the end of the last bull market. I had promised myself to stay alert for an opportunity to buy back in. Neither a bottom or several breakouts later got me back in. Now, I just keep watching…

Full disclosure: long KBH, long BBY call spread, long IBM call spread