(This is an excerpt from an article I originally published on Seeking Alpha on July 2, 2014. Click here to read the entire piece.)

I was just getting accustomed to the idea that iron ore prices could plunge without impacting the Australian dollar (FXA).

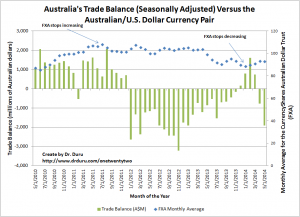

Now comes a surprisingly large plunge in Australia’s trade balance. On July 2 (Australia time), the Australian Bureau of Statistics reported that Australia’s trade balance in May dropped to -$1,199 AUD on a seasonally adjusted basis. Australia’s trade balance has not been this low since the beginning of 2013 when iron ore prices were in the middle of a recovery from a deep sell-off late in 2012.

Interestingly, there seems to be a loose correlation between the trade balance and the Australian dollar. {snip}

Click on image for a larger view…

Sources: Trade balance history from the Australian Government’s Department of Foreign Affairs and Trade; FXA prices from Yahoo Finance.

I have now put the trade balance on my radar to watch more actively. Since the last two months of negative trade balances follow a 4-month respite, it is too early to conclude that a new trend is underway. However, a negative trade balance makes sense given the Australian dollar is surprisingly high relative to Australia’s balance of trade and commodity prices (the value of imports goes up versus exports as domestic consumers take advantage of their relative buying power). One counterbalance is a swing lower in the currency…

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 2, 2014. Click here to read the entire piece.)

Full disclosure: net short the Australian dollar