(This is an excerpt from an article I originally published on Seeking Alpha on July 6, 2014. Click here to read the entire piece.)

Governor Glenn Stevens of the Reserve Bank of Australia (RBA) has finally returned to jawboning as a method for cajoling currency traders to sell the Australian dollar (FXA).

On July 3rd, Stevens provided an “Economic Update” at The Econometric Society Australasian Meeting and the Australian Conference of Economists at the University of Tasmania. In this speech, Stevens took direct aim at the Australian dollar AND at the way in which the RBA talks about the exchange rate. It was a fascinating moment of transparency:

{snip}

Stevens went on to suggest that the zero interest rate policies (ZIRP) of major central banks are partly to blame for the inflation of the Australian dollar, but also warned market participants that this was no reason to remain complacent on the value of the currency. Indeed, his warning could not be more direct or more ominous (emphasis mine):

“…we think that investors are under-estimating the likelihood of a significant fall in the Australian dollar at some point.”

{snip}

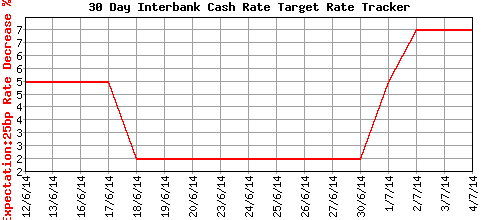

Stevens began the economic portion of the speech by downplaying the recent strength in the GDP, suggesting that it was driven by an unsustainable increase in resource exports. Perhaps ominously, he went on to note that the RBA still has room to cut interest rates even as current policy is accommodative on a historic scale and should “…be supporting demand for some time yet.” However, Stevens constructed the broad discussion of current economic conditions to set up the rationale for leaving interest rates unchanged at 2.5% for almost a year.

{snip}

Source: The August 2014 RBA Rate Tracker from the Australian Stock Exchange

Most importantly, Stevens gave very explicit instructions for how to monitor and interpret RBA communications in the future. We onlookers need to consider the full package:

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 6, 2014. Click here to read the entire piece.)

Full disclosure: net short the Australian dollar