(This is an excerpt from an article I originally published on Seeking Alpha on February 14, 2014. Click here to read the entire piece.)

Twitter (TWTR) dropped 24% after reporting much anticipated earnings on February 5th. This drop completed a quick journey from a “crescendo top” that I described (fortuitously) in late December. Shortly afterward a reader commenting on the article projected that TWTR should fall below $50 soon. I responded as follows:

” I am not so sure. $50 is nice technical support. I wrote about it here: http://bit.ly/1lEYPTS

Will write an SA article about my changed outlook soon.”

I decided to read through the Seeking Alpha transcript for the earnings call before writing the follow-up. What I learned and now understand firms up my belief that $50 should hold as support at least as long as the overall stock market remains in a bullish mood. I am much less comfortable with Twitter’s premium, sky high valuation (at the time of writing 31x sales and tops in the internet universe that I track), so I have designated TWTR as a trading stock, not an investment stock. {snip}

Let’s review a quick set of earnings highlights that define the opportunity going forward. {snip}

I will say that I am overall impressed with Twitter’s ability to turn out a (non-GAAP) profit that beat expectations despite severely disappointing on user growth expectations (30% year-over-year and 4% quarter-over-quarter; U.S. monthly active users grew 21% and 3% respectively). If even half of TWTR’s various initiatives and product experiments succeed, the company could develop the kind of revenue and then earnings growth that analysts need to issue upgrades and positive views. Currently, analyst consensus is extremely bearish on TWTR. {snip}

The big knock on TWTR’s report was the disappointingly low user growth in the fourth quarter. TWTR left the prospects for future user growth in great doubt during the Q&A session. {snip}

{snip}

Oddly enough, TWTR also claimed that it is confident it can “accelerate its user base” in 2014, and “…it will be a combination of changes introduced over the course of the year that we believe will start to change the slope of the growth curve.” So, TWTR is assuming user growth will not change much this year, but it is hoping its assumptions prove far too conservative.

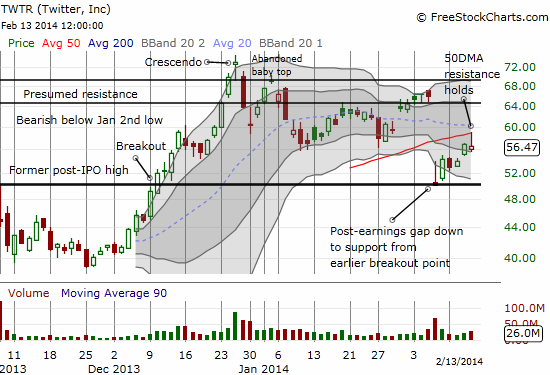

No wonder then the stock dropped as much as it did the day after earnings. Anyone who eagerly plowed into the stock ahead of earnings, especially during the spectacular run-up to the crescendo, likely sold immediately. That wash-out of sellers set up the opportunity for the bounce off $50 support – almost like the wash-out of overly enthusiastic buyers at the crescendo top. {snip}

Almost everything else TWTR had to say during earnings described a company hard at work experimenting, innovating, and developing. For example…

{snip}

After valuation, my biggest concern with TWTR is the amount of money it is spending on stock-based compensation. I had this same concern with Groupon.com (GRPN) in its early post-IPO days. {snip}

{snip}

Ahead of observing the reception for the gift of more shares, there are other metrics for assessing sentiment. The crescendo top occurred at a time with negative analyst sentiment and rising short interest. Both metrics of sentiment have gotten worse: analysts are even more negative (as noted above) and short interest continues to soar. {snip}

While negativity is not at an extreme yet, the earnings disappointment effectively catalyzed a short-term relative extreme. {snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 14, 2014. Click here to read the entire piece.)

Full disclosure: long TWTR put options