(This is an excerpt from an article I originally published on Seeking Alpha on February 20, 2014. Click here to read the entire piece.)

Since reaching an inflation-adjusted high (at the time) in May, 2012, Canada’s wholesale sales have been relatively stagnant except a one-month surge the following May that beat the high (I used the data file available in the latest report). For example, wholesale sales in November, 2013 were exactly the same as they were in April, 2012 (again, inflation adjusted). The DailyFX ranks the importance of Canada’s wholesale sales report as low for forex traders. Combining these two observations, I was extremely surprised to see the Canadian dollar (FXC) sell off so dramatically in response to December numbers that missed “expectations.” {snip}

Source: Statistics Canada

{snip}

{snip}

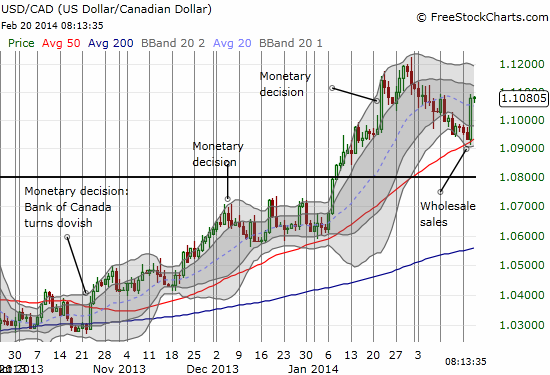

Source: FreeStockCharts.com

So it seems the poor wholesale sales numbers were just an excuse to trigger what might simply be a technical move in USD/CAD. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 20, 2014. Click here to read the entire piece.)

Full disclosure: no positions