(This is an excerpt from an article I originally published on Seeking Alpha on February 24, 2014. Click here to read the entire piece.)

On Friday, February 14, 2014, Nightly Business Report produced a timely segment on chocolate and the strong growth in worldwide demand that challenges global supplies. My ears really perked up when the segment suggested that prices of chocolate could go up as a result. I have been noticing the recent price run-ups in several agricultural commodities, and I wondered whether cocoa, the prime ingredient in chocolate, was about to experience a similar run-up. However, it turned out the story was a bit over-simplified, at least on the supply-side, and the investment thesis is tricky.

The supposed problem with supplies is that the majority of cocoa beans come from West Africa “…a region impacted by harsh weather and political instability.” This raised my eyebrows because it sounded like a boilerplate refrain lacking an update from current conditions.

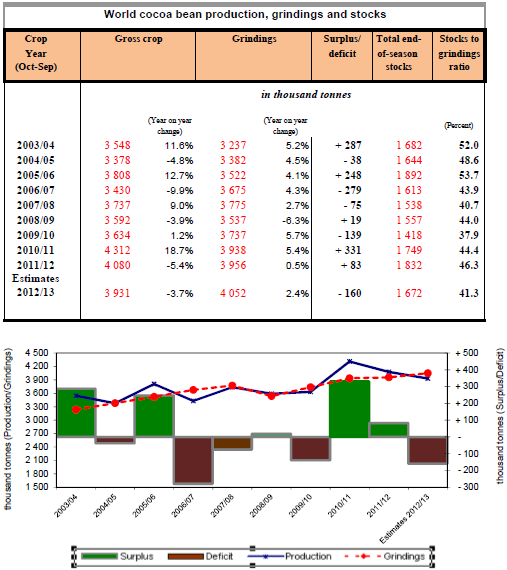

So, it is probably a lot more accurate to say that cocoa supplies can be vulnerable to political instability and poor weather conditions. Of course this warning can apply to a whole host of agricultural commodities grown across the planet. This volatility that comes with agricultural commodities makes investment most compelling in times of surplus when prices are at temporary discounts. Ultimately, the secular story of cocoa hinges on the demand side where trends are much more stable and not dependent on the unpredictability of weather or politics.

{snip}

Source: International Cocoa Organization Quarterly Bulletin of Cocoa Statistics, Vol XXXIX, No. 4, Cocoa year 2012/2013

The consistent demand growth, and the potential for accelerated growth in coming years, provides the baseline investment/trading thesis. This demand supports the rationale for buying when prices are at lows due to surplus conditions.

Nightly Business Report described cocoa demand in terms commonly used to explain increasing demand for many commodities: wealthier citizens and a growing middle class in emerging markets. {snip}

{snip}

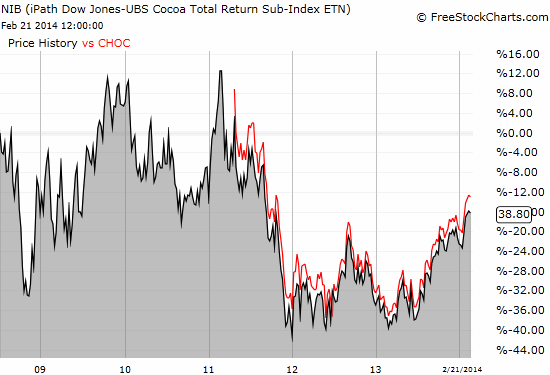

Source: FreeStockCharts.com

{snip}

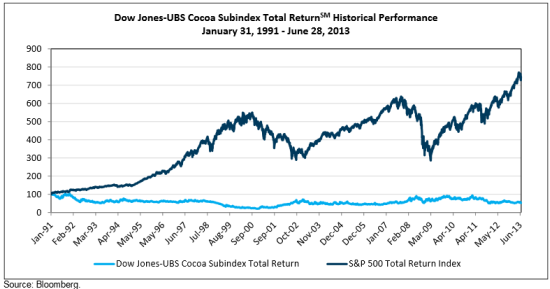

Source: NIB prospectus

I started this investigation with the implication from the Nightly Business Report that chocolate is experiencing growing demand versus constrained supply thus potentially much higher prices in the future. What I found instead is a more nuanced story of growing demand and volatile supply. The investment thesis is thus opportunistic and that window (for going long) appears to still be open for now.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 24, 2014. Click here to read the entire piece.)

Full disclosure: no positions