(This is an excerpt from an article I originally published on Seeking Alpha on March 2, 2014. Click here to read the entire piece.)

On February 6, 2014, the Wall Street Journal reported that Apple (AAPL) had snatched up $14B worth of its own stock following January’s post-earnings sell-off: $12B in an accelerated buyback and $2B in the open market. In the interview, Apple CEO Tim Cook touted how the $40B spent by AAPL to buy back stock in the past 12 months is a public company record over such a timeframe. This news likely helped AAPL run-up another 6.5% over the next 8 (calendar) days. Forbes recently provided some great perspective on the enormity of AAPL’s recent spate of buying:

{snip}

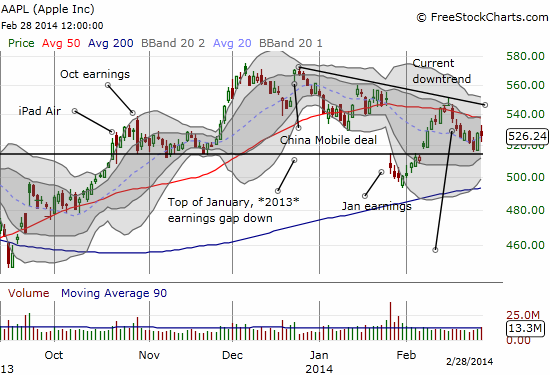

Despite the impressive scale of these purchases, they surprisingly failed to sway the growing negative sentiment in the stock. Indeed the complete reversal of those gains “post-news” over the subsequent 8 days may have its root in that negative sentiment.

Source: FreeStockCharts.com

There are many ways to look at the negative sentiment that still holds a strangle on Apple’s stock:

- Despite a year of buybacks, AAPL still trades right where it did before the post-earnings collapse in January, 2013.

- The announcement of the deal with China Mobile failed to generate any follow-up momentum and is now the top of the current downtrend. This downtrend is starting to get defined by a downward sloping 50-day moving average (DMA).

- As stated above, all the gains following news of Apple’s accelerated buyback and open market purchases were reversed in the same time it took to generate those gains.

These are all observations from the price chart. There are other clues. A Bloomberg article reporting on Apple’s annual shareholder meeting referenced a Morgan Stanley report calculating that Apple’s top 30 institutional holders held just 30% of the company’s stock. This share is a record low and is down from the peak of 40% in 2009. Even more telling could be the action in short interest and the open interest put/call ratio.

Short interest in AAPL is still a very small 3% of float. However, it is back to a 7-month high and soared from 16.5M as of January 31, 2014 to 26.4M as of February 14, a very surprising 60% increase even 8 days after the news of AAPL’s purchases. Shares short had been relatively stable since dropping to 17.6M on August 30, 2013.

The open interest put/call ratio has also soared in recent weeks providing a 1-2 punch of negativity in combination with the soaring short interest. {snip}

{snip} However, the current trading behavior in Apple’s stock suggests it will meander until April’s earnings report, perhaps even retest post-earnings lows before that point. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 2, 2014. Click here to read the entire piece.)

Full disclosure: long AAPL shares and call options