(This is an excerpt from an article I originally published on Seeking Alpha on January 13, 2014. Click here to read the entire piece.)

The Australian Bureau of Statistics (ABS) reported a loss of 22,600 jobs for December, 2013 while consensus expectations were for a GAIN of 10,000 jobs. The economy lost 31,600 full-time jobs and gained 9,000 part-time jobs. The number of unemployed increased by 8,000.

{snip}

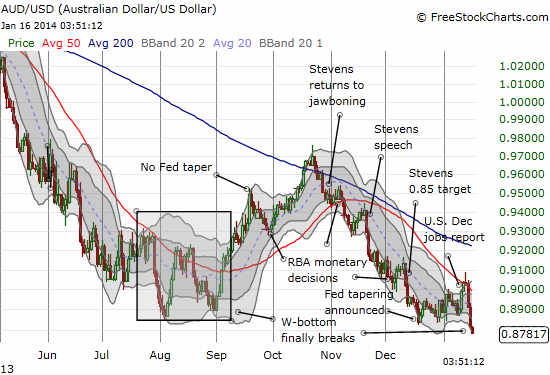

Source: FreeStockCharts.com

No surprise that this poor jobs report has driven upward trader expectations for a rate cut at the RBA meeting in early February (from 7% to 12%). This change seals my outlook going into the next RBA meeting from neutral to bearish (see “U.S. Jobs Report Pushes Australian Dollar Into Target, Australian Jobs Up Next” for my last positioning statement).

Amidst the doom and gloom, I like to look for a counter-claim or alternate story. I found an intriguing one in a piece titled “Crappy jobs data, but it is a lagging indicator” by Stephen Koukoulas, the former Senior Economic Advisor to Australian Prime Minister Julia Gillard MP. {snip}

RBA rate hike for Q1 2014 still very much in play. Activity very firm, inflation pressures inching up & global conditions still lifting

— Stephen Koukoulas (@TheKouk) December 2, 2013

To bolster his case for a trough in the unemployment data, Koukoulas points to RBA rate hikes in 2005 when employment was soft but ended up bottoming. {snip}

These claims and arguments make the RBA meeting in February stick out even more as an important tone-setter for the year. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 13, 2014. Click here to read the entire piece.)

Full disclosure: net short Australian dollar