This chart review covers the following stocks Apple (AAPL), Amazon.com (AMZN), Best Buy (BBY), Skull Candy (SKUL), Priceline.com (PCLN), Hewlett-Packard (HPQ), and Caterpillar (CAT).

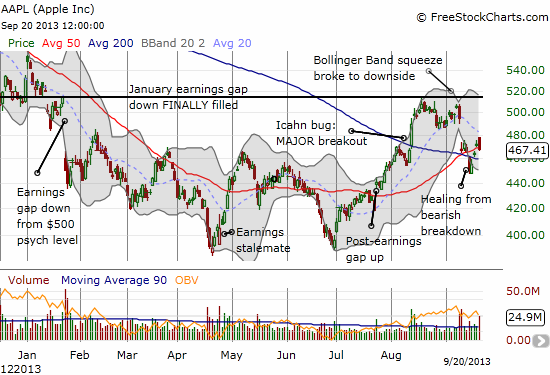

Apple (AAPL)

In retrospect, last Monday’s plunge now looks like some kind of “manipulation.” The stock plunged 3.2% on no immediate news so the selling looked like follow-through to the previous week’s selling. I was quick to note the rarity of a Monday sell-off of such magnitude and projected AAPL would end the week another 2% or so lower. Two days later the stock was rallying and hit a crossroads between the 50 and 200-day moving averages (DMAs). By Friday, AAPL had essentially closed the week flat. A lot of outsized volatility and churn that turned out to be essentially meaningless overall!

Now, the stock sits just below its 50DMA after failing to punch through the downtrending 20DMA. Friday also formed a bearish engulfing pattern. Despite all that, I bet on another up Monday given the high odds projected by my the Apple Trading Model (ATM). (The model managed a 3-2 performance last week). I will now be posting the regression tress (classification) on Google drive for each set of historical data: 2010, 2011, 2012, and 2013.

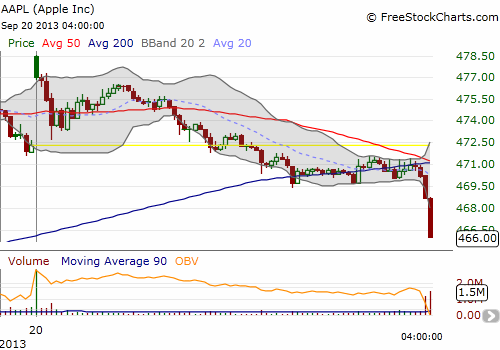

Apple closed for another down Friday. The loss deepened mainly thanks to a sudden plunge in the stock that occurred in the last 15 minutes of trading. I show the intraday chart below. Looks like AAPL started and ended the week with some suspicious selling pressure!

Amazon.com (AMZN)

AMZN is honestly driving me crazy. It is bad enough that I cannot understand why it continues to hit all-time highs. Worse is the post-earnings churn that flips the stock from bullish to bearish and back to bullish trading, quite different than the more consistent patterns of earlier that formed the AMZN post-earnings model (link takes you to a Google docs spreadsheet). My last trade was a put spread after AMZN flipped the bearish post-earnings signal. The trade was good for about two weeks but the stock lost a maximum of about 3.5% before launching into its current recovery. It was not enough to take me out of my put spread profitably and I held on in vain for renewed selling pressure. The stock exhibited impressive relative strength to close the week at fresh all-time highs after bouncing perfectly off its 50DMA on Tuesday (Sept 17th).

Best Buy (BBY)

Speaking of Amazon.com, remember how mobile price checks on Amazon.com’s site were supposed to be killing Best Buy’s business? Remember when BBY was supposedly a dying company that had only its founder and former CEO as a last desperate hope for survival through a private buyout? That all seems like a distant memory as BBY has managed to rally consistently since the 2012 Christmas holiday nadir. The stock is now up a mind-boggling 223% this year, and I do not see anyone talking about how bad BBY’s business is anymore. Amazing how sentiment can change so much faster than the real business. After the last earnings call, I decided to open a small short position. The valuation has “normalized” with a 14 forward P/E and 3.7 P/B ratio, both higher than Walmart (WMT). Only the P/S ratio is still relatively small at 0.28. At current levels, BBY is a perfect hedge on “something” going wrong with the economy, market sentiment, the consumer/retail, or any of a whole host of risk factors. Beyond that, I think sentiment will take a complete roundtrip sooner than later. It just needs a catalyst…

Skull Candy (SKUL)

You can still find Skull Candy audio accessories in Best Buy, but the company sure seemed on its last threads after the last Christmas shopping season. I still owe readers a fresh review of the company to explain why I am STILL long. On Friday, hope sprung eternal with SKUL FINALLY breaking out of a six-month consolidation pattern on high volume. This is quite a bullish development and represents a strong potential for a bottom. Perhaps SKUL can rise like a Phoenix BBY-style. SKUL will have to have a decent Christmas shopping season to have any hope of sustaining a breakout move. Brace yourselves.

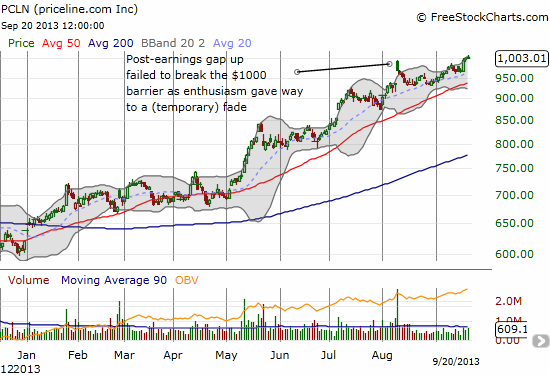

Priceline.com (PCLN)

I am really just including PCLN because I like posting about a $1000 stock. Congrats to all the PCLN bulls that have made it to this major milestone! PCLN is up an incredible 62% this year and still looks unstoppable. The poor economic conditions in Europe are clearly not impacting enthusiasm for the stock.

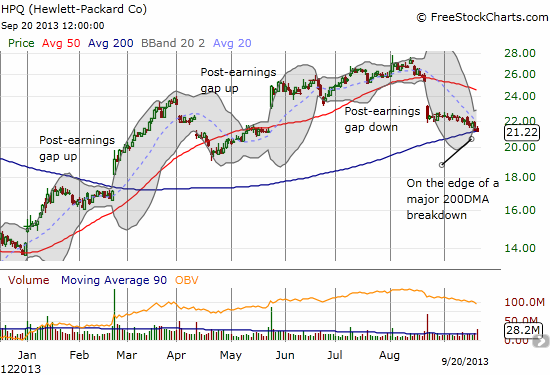

Hewlett-Packard (HPQ)

HPQ has been working on its own incredible comeback from the ashes of PC-related angst. Until the company can come up with a non-PC answer to the rapid move to mobile devices, I cannot see this renaissance lasting much longer. Indeed, August earnings disappointed and now the stock is threatening a fresh break below its 200DMA. Such a breakdown would make HPQ a classic short. It is a company that will not get bought (anytime soon), so you can actually sleep OK holding it overnight. Aggressive shorts could even add to the position on a relief rally/dead-cat bounce back to 50DMA resistance.

A break below the 200DMA will add HPQ to the GROWING ranks of companies whose momentum points in the opposite direction of the general stock market.

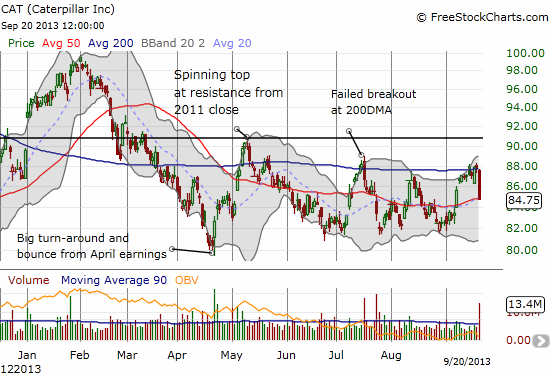

Caterpillar (CAT)

I have long maintained that CAT is like the canary in the coal mine for the stock market. 2013 has proven to be quite an exception. CAT has traded down year-to-date for most of the year, missing huge on the great rally of 2013. Since trading down to flatline year-to-date in late February, CAT has traded in a wide range. Last week, the stock survived issuing guidance at the Citi Global Industrials Conference and then more bearish talk from famous short-seller Jim Chanos who has a large short position in CAT. But on Friday, out of seemingly nowhere, CAT plunged over 3.4%. Like AAPL, my first thought is options-related manipulation, but I do not have access to data to even make an educated guess. Overall, CAT is dead money until it either breaks out or breaks down. I am including it here just because Friday’s high-volume selling woke me up and caught my attention. I am watching ever more closely (especially since I still own a small amount of shares!).

Jim Chanos talks bearish China and the commodities super-cycle

Be careful out there!

Full disclosure: long AAPL shares and calls, long SKUL, long CAT, short BBY