(This is an excerpt from an article I originally published on Seeking Alpha on April 30, 2012. Click here to read the entire piece.)

On March 8th, 2012, Molycorp (MCP) announced a critically important acquisition of Rare Earth Processor Neo Material Technologies. The next day, the market responded by sending MCP shares up 19%. Almost two months later, the enthusiasm has clearly waned with most of the post-acquisition gains now lost. {snip}

Source: FreeStockCharts.com

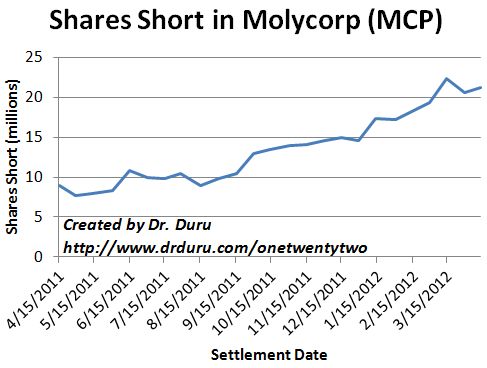

I am guessing that the initial response was so strong because short interest approached or reached a 52-week peak ahead of the announcement. {snip}

Source: NASDAQ.com short interest for MCP

Commodity-related stocks in general have lagged in 2012. While MCP is up for the year, it has sorely lagged over the past year. I asked a friend of mine for his thoughts on MCP’s latest inability to maintain its gains. He gave me several bulletpoints:

{snip}

He added that this price weakness SHOULD be a buying opportunity assuming previous statements or implications from Molycorp remain true:

{snip}

I think until MCP’s ramp-up begins in earnest and the evidence of that ramp becomes undeniably palpable, the market will continue to ignore MCP’s positive longer-term story. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 30, 2012. Click here to read the entire piece.)

Full disclosure: long MCP