This is an excerpt from an article I originally published on Seeking Alpha on December 5, 2011. Click here to read the entire piece.)

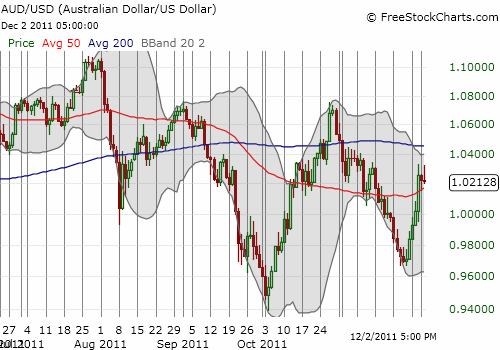

The Australian dollar was a particularly strong beneficiary of last week’s bullish euphoria. Although the dollar index has only lost about 1% since its most recent peak on Friday, Nov 25, the Australian dollar surged against all major currencies. The Aussie gained 5% over the U.S. dollar (note the Aussie is not a member of the dollar index).

{snip}…The coordinated action by central banks to ease borrowing terms for U.S. dollars caught a lot of attention and overshadowed the even more important news that China cut its reserve requirements for commercial lenders. Both actions confirm the fragile condition of the global economy, but China’s action signals that monetary policy has clearly switched from tightening to accommodation. It underlines the Reserve Bank of Australia’s (RBA) decision on November 1 to cut interest rates for the first time since April, 2009…

{snip}…

Other implications for my moderating bullishness on the Australian dollar:

- I will be more patient in buying dips on the Australian ETF, the iShares MSCI Australian Index Fund (EWA).

- On a related note, I am assuming that the “commodity crash” scenario is even further delayed as freshly accomodative monetary policy around the globe puts a near-term floor under commodity prices.

- When (if?) commodities crash, it could be even worse than anticipated to the extent that easier Chinese monetary policy leads to ever more marginal loans and poor investments.

{snip}

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha on December 5, 2011. Click here to read the entire piece.)

Full disclosure: Long FXA, long AUD/USD