During a conference call on September 14th, investors urged Great Western Minerals Group (GWMGF.PK) President and CEO Jim Engdah to fill the company’s financing needs with a share offering. They preferred dilution to the potential of selling the company short in an offtake deal. They insisted time was of the essence while the stock was at a relatively high price. The CEO seemed sympathetic to their urgings but also pretty confident in his ability to execute a fair deal; a dilutive share offering sounded like it remained on the bottom of the list.

After the stock lost almost 50% in value over the next three weeks, it seems the CEO found religion. On October 27, Great Western announced a private placement of a minimum of $15M worth of common shares “…for the continued development of its Steenkampskraal project in South Africa as well as for general corporate expenses.”

Engdahl’s explanation was quite telling:

“We have carefully considered the various financing options available and feel an equity financing will provide the Company with the greatest flexibility in the short term. Ensuring we have adequate capital on hand puts our Company in a much stronger position as we continue to evaluate non-dilutive financing mechanisms such as joint ventures/off-take agreements and debt instruments.”

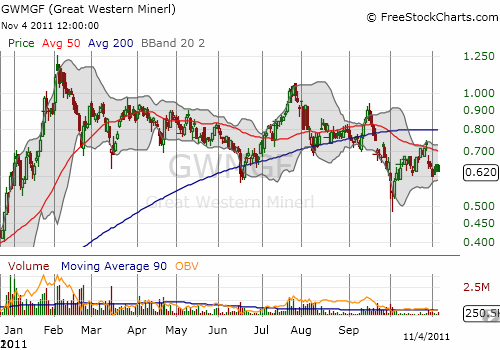

The next day the stock lost 11%, around the amount that investors predicted. On October 31, Great Western announced a pricing of 23.8M shares at $0.63/share (Canadian dollars?) to be executed no later than November 10, 2011. The stock is currently selling at $0.62/share (U.S. dollars). At 50% of its all-time highs from earlier this year, Great Western is a pretty good bargain. I am looking to buy back in soon as a part of the “commodities crash” playbook.

Source: FreeStockCarts.com

Be careful out there!