Excerpt from an article I published on Seeking Alpha. Click here to read the entire piece:

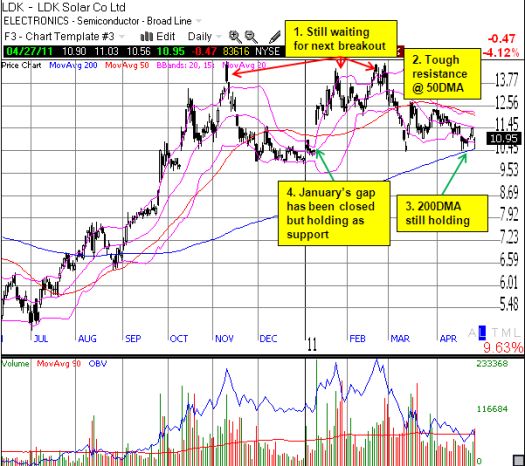

Three months ago, LDK Solar (LDK) wowed the market with a tremendous hike in guidance for both the fourth quarter of FY10 and the entire FY2011. The stock closed up 18% on the day. LDK went on to retest 52-week highs before quickly closing January’s gap up in the market’s post Japan-quake swoon. Last week it retested those levels again.

Tuesday evening, LDK turned the tables and warned on first quarter guidance but held firm on its fiscal year 2011 guidance. By sticking to the full year guidance, there is essentially no news here but the market responded by selling off the stock by 4% to $10.95 on an otherwise strong day for the stock market. This move still left intact the support of the 200-day moving average (DMA). The March lows have held as well.

*Chart created using TeleChart:

…it is important to note that LDK’s stock has failed to make progress since the close before January’s blockbuster guidance. In other words, LDK can be purchased at a price that essentially ignores any good news for the remainder of the year….

(Click here to read the entire piece on Seeking Alpha)

Be careful out there!

Full disclosure: long LDK calls