Casino stocks have soared since the July market lows. September in particular has featured some near parabolic moves as shorts get squeezed and risk-seeking behavior has accelerated.

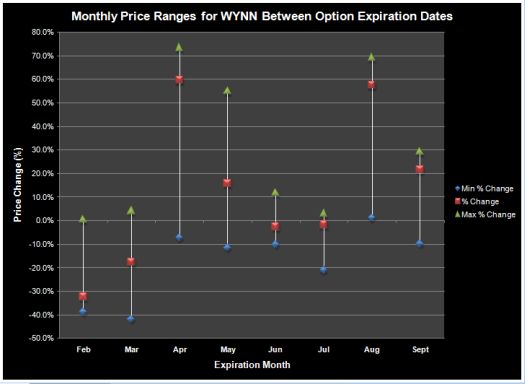

Wynn Resorts Ltd. (WYNN) has caught my attention the past two months because its large swings in stock price have made option strangles quite profitable. In a strangle, a trader opens a position in calls and puts at different strikes (for the same month in this case). A typical position will utilize out-of-the-money calls and puts in anticipation of a large move by expiration. WYNN has experienced large monthly swings all year. The chart below shows the monthly price range in WYNN’s stock between option expirations. For example, the line for September shows that from the close of August expiration to the close for September expiration, WYNN dropped as much as 10%, increased as much as 30%, and ended up with a 21% change.

For October expiration, I am scaling into the Oct 80 calls and Oct 60 puts. Each strike is well within the monthly ranges shown above. From the current print at $70.50, a 12% move takes WYNN to the Oct 80 strike, and a 16% drop takes WYNN to the Oct 60 strike. If historical patterns hold up, I thus expect at worst to break even. If WYNN experiences a surge (in either direction) within the next two weeks, I expect the strangle to be very profitable as the value of the position overcomes rapid time decay.

I am choosing a strangle again because, although I expect a significant market correction sometime this Fall, the absence of such a correction will likely send speculative, highly shorted stocks like WYNN hurtling ever higher. (one of Doug Kass’s strategies for dealing with incorrect tactical trades is to buy out-of-the-money options). Here are some catalysts that could get WYNN swinging far and wide in the coming four weeks:

- China easing gambling restrictions in Macau and expectations for record takes in October.

- Conversely, the above optimistic expectations fail to materialize and/or China suddenly reverses course in its policies.

- Continued excitement over WYNN’s coming Macau IPO as the company recently increased the size of the offering…and, of course, the potential bust if sellers rush to take profits quickly.

- News regarding consumer discretionary spending and savings levels.

These catalysts alone have a lot of explosive potential. The general stock market throws one more firecracker into the pot. If this trade is successful for a third month in a row, I may make it a regular staple of my trading as long as such strong catalysts exist for WYNN.

Be careful out there!

Full disclosure: long puts and calls in WYNN

2 thoughts on “Strangle Options Play in WYNN”