Wiping Away

A Decade of Pain

By Duru

April 11,

2005

In March, I

FINALLY got excited enough about commodities to start dabbling in them. Turns out that I was just

in time to join mass opinion. In March, rising commodity prices were

making regular headlines that made top-billing in screaming bold letters. If you did not know about the rising inflation pressures that had even the Fed

frowning, then you simply were not paying attention to financials markets

at all. I have long been bullish on oil

(although not putting my money where mind is enough), gold, and other mining

stocks, but in March I finally dabbled a bit more….steel, Brazilian resource

plays, heck, even uranium! After steel

quickly made a top, I had to retract my claws and munch some humble pie. With the excitement placed back in its cage,

I took a more sober assessment of the overall situation. I will use Oregon Steel (OS) as an

illustrative example of the do-or-die situation I see out there. I like this company and think they have a

good business, but the stock is not performing well of late. (Click here for my standard disclaimer).

First, this

daily chart shows how OS completed a neat double-top in March:

This weekly

chart that stretches back into 2002 shows just how late my interest in OS was

in the run for this current bull cycle.

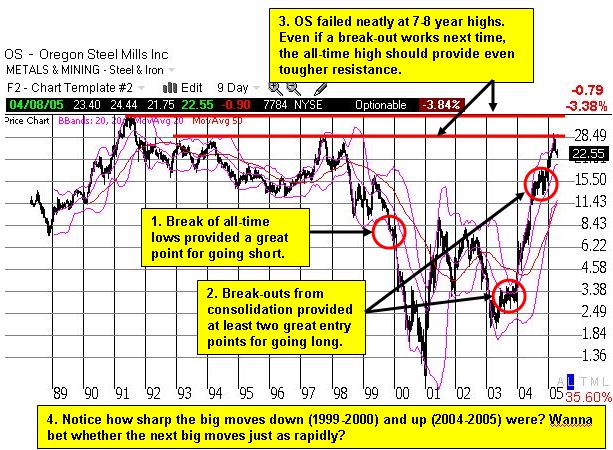

Finally, this 9-day chart shows that OS has been an

extremely poor long-term investment. The

stock essentially spent 10 years of pain, the entire 90s, in slow and steady

decline until a breakdown from the 11-year low finally set-up a sharp snapback

rally. Another correction in early 2003 set-up Oregon Steel's first multi-year rally since the late

80s! Amazing, right? And NOW I want to get interested?! Is two years of

stellar, hypersonic growth enough to erase 10+ years of pain?! Oregon Steel has now failed to break a high

punched out in 1997 and even if it does, we have to believe that the all-time

high set in 1991 will provide the ultimate wall. I imagine a failure there will signal the

final end of the run in OS (and steel) for this business cycle.

For final

emphasis, and perhaps a few good snickers and laughs, here is a chart of a

commodity index which clearly demonstrates how I picked a distinct top to

finally get deeply interested in the commodity story. Sure commodities could run again, but the

chart clearly shows that the time to buy is on sharp pullbacks (assuming you

believe in the fundamentals) and, even better, break-outs from consolidation

patterns.

So what to do

now? If the Fed continues to raise rates

and issues more and more hawkish statements on inflation, we should be very

cautious about diving into commodities.

But I think only a recession or similar economic malaise can completely

stop the march upwards: the U.S. dollar

remains weak,

Be careful out

there!